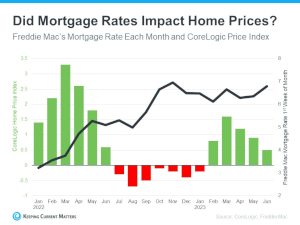

There has always been a direct correlation between interest rates and home prices. The rule of thumb has always been when rates go up prices go down, and vice versa. This was temporarily proven true in the summer of 2022 when rates quickly rose by 2% (3.5%-5.5%) over 5 months. It created a price correction in the second half of 2022 as buyers retreated from the market due to affordability. One should note that price acceleration was rapid from May 2020 to May 2022 and in that two-year period prices grew upward of 50% in King and Snohomish Counties. That was an unsustainable pace. In all honesty, this was inflation’s role in the housing market, and increasing the rates was the Fed’s way of getting control.

There has always been a direct correlation between interest rates and home prices. The rule of thumb has always been when rates go up prices go down, and vice versa. This was temporarily proven true in the summer of 2022 when rates quickly rose by 2% (3.5%-5.5%) over 5 months. It created a price correction in the second half of 2022 as buyers retreated from the market due to affordability. One should note that price acceleration was rapid from May 2020 to May 2022 and in that two-year period prices grew upward of 50% in King and Snohomish Counties. That was an unsustainable pace. In all honesty, this was inflation’s role in the housing market, and increasing the rates was the Fed’s way of getting control.

While there was a correction from May 2022 to January 2023, since then prices have started to grow again despite the rates hovering in the 6-7% range. In fact, the median price is up from the bottom (Jan/Feb 2023) by 13% in King County and 9% in Snohomish County. Further, the median price in July 2023 was even with July 2022 in King County and down by only 2% in Snohomish County. This is a sign of price stabilization. Historically, the impact rising rates have on prices year-over-year is not negative. We are in the midst of proving that same theory.

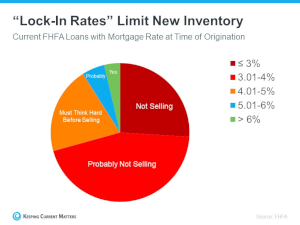

Believe it or not, the higher rates are keeping prices stable because it is limiting the available inventory for sale. You see, there are plenty of buyers out looking for homes right now, and inventory levels are tight because potential sellers are waiting to make a move because they are holding on to their low rate. Our job market is good, we have people moving to our area and the millennials are out in full force searching for their first homes.

Believe it or not, the higher rates are keeping prices stable because it is limiting the available inventory for sale. You see, there are plenty of buyers out looking for homes right now, and inventory levels are tight because potential sellers are waiting to make a move because they are holding on to their low rate. Our job market is good, we have people moving to our area and the millennials are out in full force searching for their first homes.

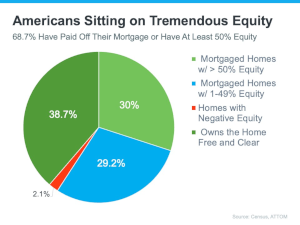

There are two interesting phenomena going on with potential home sellers right now. First, according to ATTOM Data, 68.7% of homeowners have at least 50% equity and only 2.1% have negative equity. This is the number one indicator that we are not in a housing crisis or bubble. Second, according to FHFA, 70% of homeowners with a mortgage have a rate 4% or lower. This is causing people who are no longer happy with where they live to stay a bit longer because they don’t want to give up their payment just yet.

Here’s the deal though, housing is a reflection of life! According to the US Census, 66% of homeowners would like to upgrade to a nicer home with features that better match their lifestyle, and 45% would like to move to a home to better match the changing size of their household. Life changes motivate moves! Many people are waiting out these life changes until rates come down so they can better afford their desired transition. This has put downward pressure on inventory, limiting selection for buyers, hence creating price growth and stabilization.

Here’s the deal though, housing is a reflection of life! According to the US Census, 66% of homeowners would like to upgrade to a nicer home with features that better match their lifestyle, and 45% would like to move to a home to better match the changing size of their household. Life changes motivate moves! Many people are waiting out these life changes until rates come down so they can better afford their desired transition. This has put downward pressure on inventory, limiting selection for buyers, hence creating price growth and stabilization.

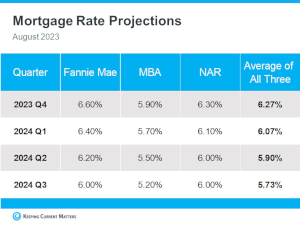

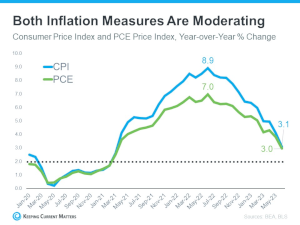

So, what is going to happen when rates come down? Experts across the board predict that rates will recede as inflation gains control. This will be a gradual process over the next 12-18 months. The biggest indicator will be inflation reaching the 2% year-over-year mark. Once we hit this point, which we are close to, experts predict the Fed will be comfortable easing off the higher rates. This will cause more homes to come to market as the delta between the rate a homeowner currently holds and what they are willing to take on to indulge their desire to move, will become more attainable. Plus, as rates recede it will increase buyer demand.

We find ourselves in a delicate dance with inflation, rates, inventory, and prices. Someone who desires a move has to consider the impact the rates can have on their payment. Many of these buyers are taking the leap and finding creative ways to offset the rate such as ARM financing, rate buy downs, or they are preparing to re-finance their purchase when rates come down. This way they will have secured a good price which is the basis of their loan.

We find ourselves in a delicate dance with inflation, rates, inventory, and prices. Someone who desires a move has to consider the impact the rates can have on their payment. Many of these buyers are taking the leap and finding creative ways to offset the rate such as ARM financing, rate buy downs, or they are preparing to re-finance their purchase when rates come down. This way they will have secured a good price which is the basis of their loan.

So, do you stay or do you go? According, to the lyrics from the classic song from The Clash, “if I stay there will be trouble, but if I go there will be double.” This is up to you to decide. Where I can help is to gather the data and help you analyze the market in order to empower you to make the best choice for you and your family. For some, the right time is now and for others, waiting a bit longer will be a good plan.

What I do know, is that when we hit the inflation rate that the Fed is comfortable with and they ease off of rates, the market will tilt. This will be a benefit for some and a challenge for others. In other words, there is not one right answer for everyone and that is where I think I have the opportunity to serve my clients best.

Helping people navigate the ever-changing market is a skill, an art, and a calling. I am here for it and find great satisfaction in helping people make big life decisions that help bring joy, solve problems, and make them money! My job is a huge responsibility and it is an honor to serve my clients. If you or someone you know are wondering about how today’s market conditions affect your goals, please reach out. We can dig into the data, assess your dreams and devise a plan.

Helping people navigate the ever-changing market is a skill, an art, and a calling. I am here for it and find great satisfaction in helping people make big life decisions that help bring joy, solve problems, and make them money! My job is a huge responsibility and it is an honor to serve my clients. If you or someone you know are wondering about how today’s market conditions affect your goals, please reach out. We can dig into the data, assess your dreams and devise a plan.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link